used car loan EMI calculator

Instantly calculate your second hand car loan’s monthly payment (EMI) with our real-time tool. Adjust the loan amount, interest rate, and tenure to see how it impacts your repayment schedule, total interest, and plan your car finance wisely.

Used Car Loan EMI Calculator

Total Interest

Total Payment

Amortization Schedule

| S.No. | Month & Year | Principal | Interest | Balance |

|---|

What is a used car loan EMI calculator?

A used car loan EMI calculator precisely estimates the fixed Equated Monthly Installment (EMI) for a loan on a pre‑owned vehicle loan by applying the standard amortization schedule to the loan amount, interest rate, and tenure in months.

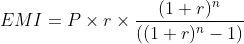

The industry formula used by all the financial institutes is:

where P is principal, r is the interest rate, and n is the total months.

Each instalment splits into interest on the declining balance and principal reduction, which is why early payments are interest‑heavy and later payments principal‑heavy.

With the Indian used car market set for robust growth in 2025, tools like this are vital for informed decision-making. As per an IndianBlueBook (IBB) forecast, the market is poised to grow over 15% this year, making financing a key consideration for millions of buyers. Moreover, typical used‑car APRs in India are around 10.15%–15.55% p.a in 2025. This rate is fairly higher than that of new cars, and it indicates a customer/borrower should plan their loan judiciously for a proper financial planning.

How to use the EMI calculator

Calculating your monthly outgo with our tool is an intuitive process. Simply manipulate the three primary inputs provided.

- First, enter your required loan amount using either the slider or the text box.

- Next, input the annual interest rate quoted by your lender.

- Finally, adjust the loan duration to your desired repayment period.

The calculator then applies the amortization formula and displays EMI and a detailed schedule instantly. It is engineered for dynamic feedback; all output figures, charts, and schedules update in real-time as you adjust the parameters.

Benefits of our Used Car Loan EMI Calculator

This pre-owned car loan EMI calculator is a dynamic financial simulation tool, not just a simple calculator. It is the best in the segment because of the following 5 reasons:

- It provides instantaneous feedback. There is no “calculate” button; every adjustment you make to the loan amount, interest rate, or tenure updates all results in real time. This allows for rapid and effortless scenario analysis.

- Visuals clarify the financial journey. Our yearly stacked bar chart demystifies amortization. It shows precisely how the principal-to-interest ratio in your EMI shifts favorably over the loan’s life. A separate pie chart breaks down your total payment, clearly distinguishing the principal amount from the total interest cost over the full term.

- The integrated Prepayment Feature transforms this tool into a debt-reduction strategist. You can model the impact of extra monthly payments, showing you exactly how much interest is saved and how much the loan tenure is shortened. For example, a modest ₹2,000 monthly prepayment on a ₹5 lakh loan (at 10% for 5 years) saves over ₹21,000 in interest and shortens the loan by 10 months.

- This platform also aligns with current market realities. With used car loan interest rates in India typically starting around 11.25% p.a., our calculator allows for essential sensitivity testing across this band. Furthermore, it operationalizes the principles behind the RBI’s directive for a no-prepayment-charge regime on floating-rate loans, effective January 1, 2026, helping you visualize future financial flexibility.

- Finally, you can download or print a full amortization schedule, providing a clear record for meticulous financial planning.

Frequently Asked Questions

A Used Car Loan EMI (Equated Monthly Instalment) is the fixed monthly payment you make to repay your loan. It’s calculated using your principal loan amount, the interest rate, and the loan tenure (duration) with a standard mathematical formula.

A used car loan differs from a new car loan primarily in its interest rate and loan tenure. Used car loans typically have slightly higher interest rates and shorter maximum tenures due to higher risk associated with older vehicles.

The information you need to use this EMI calculator is the loan amount you wish to borrow, the annual interest rate offered, and the desired loan tenure in years and months.

The primary factors that affect your car loan EMI are the principal loan amount, the interest rate charged by the bank, and the loan tenure. Any change in these factors changes your EMI.

Changing the loan tenure affects your EMI and total interest inversely. Shorter tenure increases your EMI but reduces total interest. Longer tenure reduces your EMI but results in higher total interest.

The amortization schedule provides a month-by-month breakdown of your loan repayment, showing how much goes to principal and interest each month, along with remaining balance.

The funding you can get for a used car typically ranges from 80% to 90% of the car’s valuation price. The final loan amount depends on the car’s age, its condition, and your credit profile and eligibility.

The average tenure for a pre-owned car loan is generally between 3 to 5 years. While some lenders may offer up to 7 years, the maximum tenure is usually shorter than for a new car loan due to the vehicle’s age.

Yes, the interest rate on a second-hand car loan is typically 1% to 3% higher than for a new car. Lenders charge more because older cars have a higher depreciation rate and are perceived as having a greater risk of default.

Yes, absolutely. Your credit score significantly affects the interest rate. A higher credit score (typically 750+) demonstrates financial reliability and can help you secure a lower interest rate, saving you a substantial amount over the loan’s duration.

Yes, it can be highly advisable, especially if you get a well-maintained vehicle. A loan for a used car results in a lower total loan amount and a faster repayment period compared to a new car, making it a budget-friendly option.

A typical down payment for a used car is recommended to be 15% to 20% of the car’s purchase value. A larger down payment reduces your loan amount, lowers your EMI, and can help you secure a better interest rate from the lender

Making extra payments (prepayments) helps you save money by reducing the outstanding principal amount of your loan faster. This means less interest accrues over the remaining tenure, leading to significant interest savings and an earlier loan closure

Foreclosure penalties may apply, usually between 1% and 5% of the loan balance, depending on lender policies. This depends on the banks and hence it is crucial to check the specific terms with your lender beforehand

The documents typically required are identity proof (Aadhaar, Passport),address proof, income proof (salary slips, bank statements), the car’s Registration Certificate (RC), and the car’s insurance papers.

Most lenders finance cars up to 5-8 years old, ensuring the loan tenure ends before the car turns 10 years old. A car’s age eligibility for financing varies by banks. There are banks which allow up to 12 years or more. Some lenders may finance older cars, but often with shorter loan terms, stricter conditions, or a larger down payment.

Interest rates vary, but banks like SBI, HDFC Bank, and ICICI Bank are often competitive. The best rate for you depends on your credit score, income, and relationship with the bank. It’s crucial to compare current offers from multiple lenders.

No, not all banks finance every model. Most banks have an internal list of approved models and may be hesitant to finance discontinued or less popular cars. They prefer vehicles with good resale value and easy-to-source spare parts.

A bank determines the value through a professional valuation process. An authorized third-party appraiser inspects the car’s condition, age, mileage, and model history to establish its Insured Declared Value (IDV) or market value, which then determines the maximum loan amount.

After using the calculator to estimate your EMI, the next steps are to check your loan eligibility, gather the required documents, approach a lender or bank, and submit your loan application along with the car’s details for valuation and approval.